| |

PROFIT Data, US, 1990-2010

that affect US Industry

| US PROFIT Data from 1990 - 2010

Sources: US Department of Commerce, group: BEA (US Bureau of Analysis) for Income, Expense and

Profit, DocStoc.com for Unemployment. For references, see

HERE. FORWARD, and ANALYSIS This raw

information comes from the US records, US Department of Commerce, BEA as shown above.

Note that the US Department of Commerce gives figures that include all

of federal, state and local, and not just federal. This is

my third update on this page. What this shows me is that while it

is quite hard to find the raw US official data, it is far harder to

analyze it. I have determined that it is harder to analyze since

there are many factors. Some periods have "peace in our time" and

have an edge. Other periods may have wars, or perhaps even worse,

recessions. Some of these issues are external to governments.

But even if not, is who controls Congress more important? Or who

controls the Presidency? And if there are issues like recessions,

then what did that group do to solve those issues and were they

effective? So it can get complex. And yes one must work to

be fair. But here are a few things I believe I see in the below

graphs:

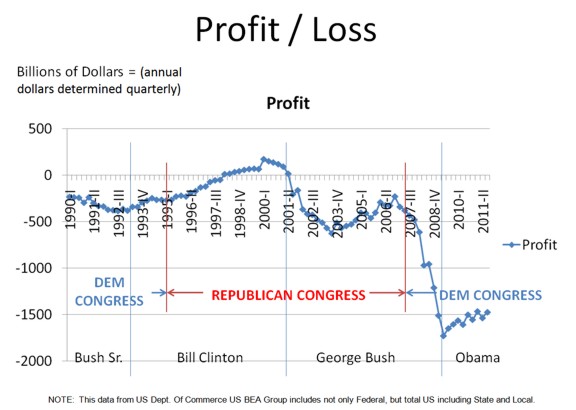

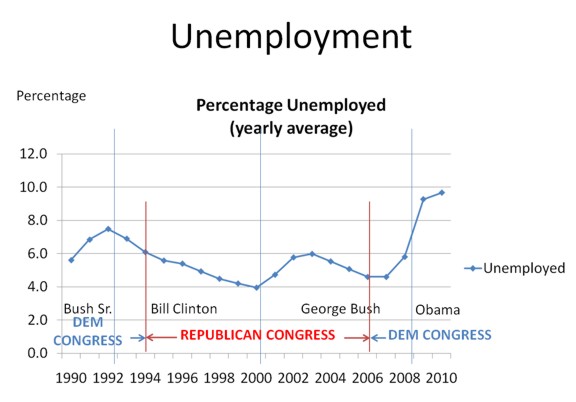

- 1994-2000 With a Split Washington DC with Democrat Bill Clinton

in office and a Republican Congress, they apparently worked well

together and we had 6 of our best US years with low unemployment and

profit rising to get the US to at least not add more debt.

Some people have given me their opinion that a split government is

best, since checks and balances are then in place as our founders

intended.

- The Republican versus Democratic thing? The last ten years

have been bad financial years for Americans. Bush lost us

about $5 trillion in added debt and Obama just over $3 trillion his

first two years.

Of course Bush had four times as much time to lose money so that

means Obama is losing it more than twice as fast. And one

could say that at least Bush was honest since during a book signing

he said he knew nothing about finance. Okay, got it. But

that was supposed to be what a cabinet is for - to advise. But

regardless of whose reasons we like the most, both lost money and

drove the US into financial problems.

- 1994-2006 These years are mostly okay and do coincide with the

Republican Congress being in office. This makes me wonder if

it is more important who is in charge of Congress rather than the

President.

- Recessions - the most obvious ones are two in 2001: the

dot.com recession and 911, and the housing/mortgage recession in

2008. These did influence the period above this comment and

also the Bush years below it

- 2000-2008 - The Bush Years. I am not going to claim that

Bush was a financial genius, but what I see is that he received more

criticism than he should. He had two recessions at the start

of his office in 2001, the dot.com recession and the 911 recession

which affected travel. I do not see how one could blame him

for either of those fairly. I do believe George Bush was often

slow to take action, as during these recessions and also Katrina,

but some of his techniques to me at least seem reasonable. The

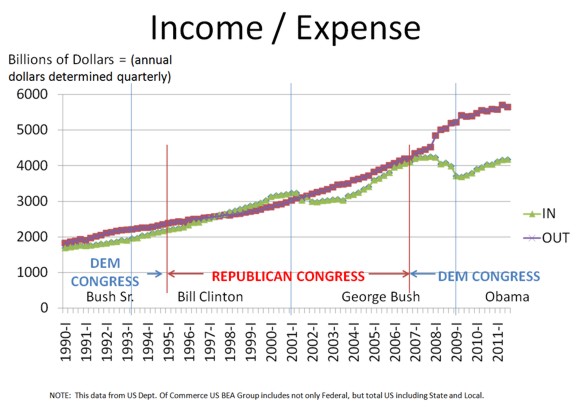

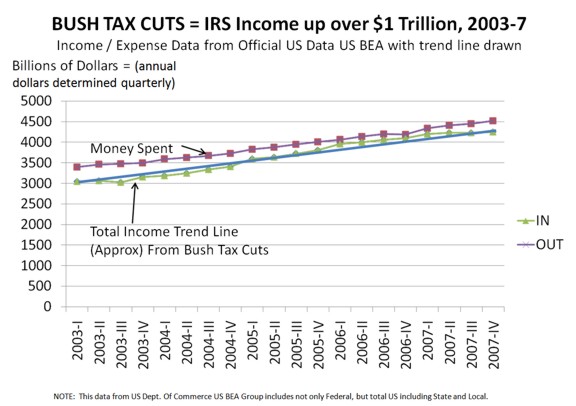

Bush Tax cuts for the middle class and also "the rich" as some like

to complain about, did work well between 2003 and 2007 even though

some of his critics today claim the opposite. While some say giving

tax breaks to the rich costs the US money, that is not in evidence

as you can see from the Income/Expense graph that IRS income

actually rose in that period well, and of course also the profit

graph rose well which is really income-expense, as you might judge

any business.

- WAR COSTS - Some people do claim that the Bush era was mainly

huge losses due to war. If you look at the graph, that is not

in evidence. Certainly there was a war cost but the Bush years

in my opinion were mostly dominated by three recessions and then

recession recovery. Certainly the war costs added to push this

graph downwards, but how much is hard to see. One would need more

information. However, I will make the statement that if

someone claims the Bush years are due solely to war costs, that that

is just wrong. The graphs shows mostly recessions and

recovery.

- BAILOUTS - This is for each taxpayer to decide. But what I

have learned recently is that while both TARP and STIMULUS are both

bailouts, they have huge differences. While many US taxpayers

are against bailouts of any kind, some economists do try to tell us

that if you have a run on the banks, some temporary money to stop a

landslide and then banks going out of business is a good idea.

That is TARP. TARP done by Bush was for the emergency of the

run on banks and also was a loan. As of this time, I

understand that all of TARP has been repaid but about $150 billion,

so that is not causing the major amount of our increasing US debt.

However, STIMULUS as done by Obama was not done for an emergency on

a run on banks and was not a loan but money given away forever.

Its purpose was for those who believe in the Keynesian philosophy

that during a recession throw money at the problem to stimulate the

economy. But the money left the US taxpayers and the

unemployment remains at 10% or so. I am certain that whoever

wanted stimulus had good intentions. But as a taxpayer I think

it looks to me that unlike TARP, it did not work and was not a good

idea.

View the below data, or

skip ahead to another page for: profit -1969-1990

or profit 1947-1969 or

profit 1929-2010 |

|

|

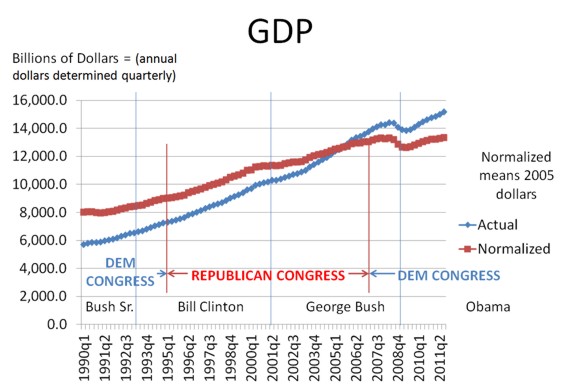

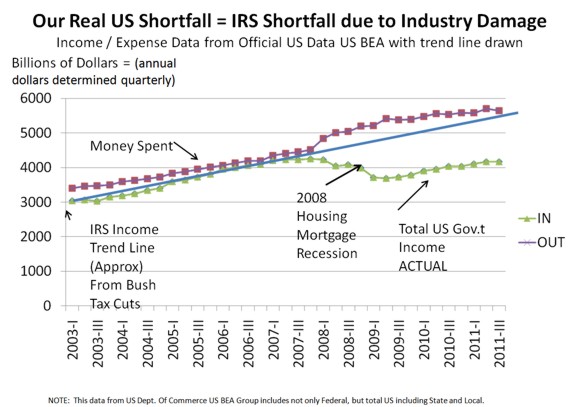

This GDP chart seems mostly to go up except for the 2008-9

US Housing Mortgage-caused recession.

Note first of all that of course income and expense are very much related to

the profit curve ahead. Aside from some US financial correction items,

the profit above is basically income minus expense. And of course

income for the US government is mostly IRS income.

This graph behavior in my mind is not so hard to understand since to me it

somewhat follows the profit curve. Hurt by three recessions, and some

improvement in between.

|

|