|

rpsoft 2000 ILLUSTRATED US DEBT CHOICES Graphs, Charts From USA Data |

|

ILLUSTRATED US DEBT CHOICES

Illustrated Government Debt Examples –by Ron Plachno

With all of the debt discussions going on, one would think there are many options. Perhaps. But some help the situation and some hurt. Since some of this may seem confusing I will use simple examples. You will see numbers like 100 or 20. To make it more realistic, assume those are thousands of dollars. So then 100 = $100,000, and 20 = $20,000 for example. This also gets into the question – did FDR do good when he created Government jobs? Answer no – and we will show that. But the basic issue is money. IF the government pays someone $100,000 a year (that will show as 100 in our examples) then that person may pay back the government $20,000 or 20% of the $100,000 in taxes. Where does the other 80% or stated in money: $80,000 come from? It must be paid outside of the government by the private sector. So for each government employee, on the average, at 20% tax, there would need to be four similar workers paid the same and taxed the same in the private sector to pay the bills. This is shown by the following example:

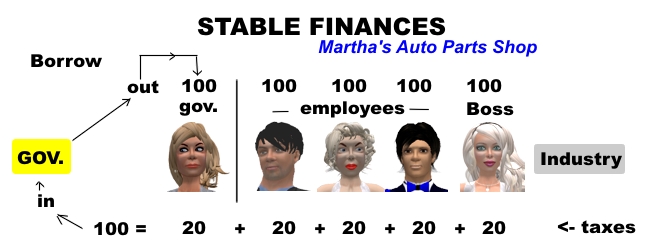

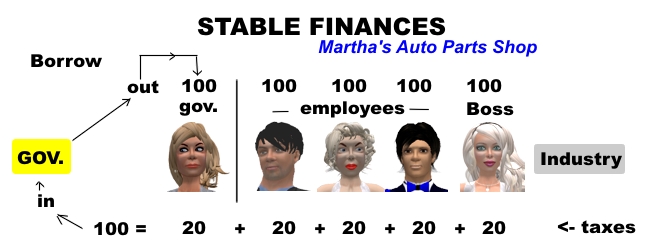

STABLE GOVERNMENT FINANCE – just staying even

In this example the government wishes to hire an employee and does, and pays her $100,000 a year. In return she pays the government taxes of $20,000 a year. That leaves the government $80,000 short. So the government makes up the difference in the private sector by taxing 4 other citizens. In our example, the one paying this money is one small business: Martha’s Auto Parts Shop. Martha, the boss on the far right owns the business and pays the three employees left of her each the same money she makes. She has two parts experts/mechanics and one sales and office clerk. All these four plus our government employee make $100,000 a year in this simple example. All pay $20,000 each in taxes. Since five people pay $20,000 each in taxes, the government takes in $100,000 total – just enough to pay their one employee. So this system is stable but no economy growth.

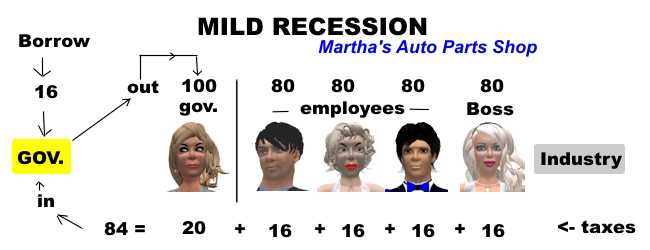

Next let us look at a mild recession – where unemployment is not bad but business losses cause a drop in pay for Martha and her employees:

MILD RECESSION – loss in business and pay but no unemployment

In the above, Martha decides to “weather the storm” and decides that she and all three employees will take a pay cut temporarily. They do that. But then their taxes drop with their lower pay. The government now takes in only $84,000 in taxes, and must borrow $16,000 more in order to pay their one employee – whom they decided should not get a pay cut. Other than that, the government does nothing.

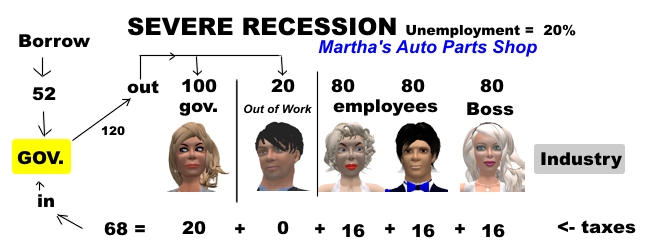

SEVERE RECESSION – with unemployment

In the above example, Martha can no longer make ends meet with business way down and is forced to lay off one employee Bart. At first, Bart does not care that much since Bart knows he will be paid some unemployment and is almost looking forward to the time off. But his taxes are now missing in total and the government pays Bart unemployment of perhaps $20,000 a year. This means the Government now is taking in only $68,000 but must give out $120,000. The government realizes it must do something quick with 20% unemployment – a similar situation to what we have now. But what to do? What to do? Different people in the government suggest different things, but there seem to be three suggestions: (1) raise taxes, (2) give out government jobs to create jobs fast (3) fix the problems affecting industry. They try each in a row.

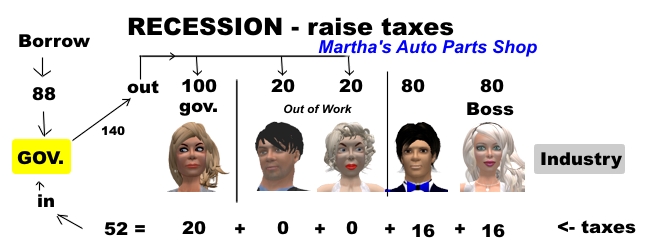

RAISE TAXES – during a recession

The government decides to raise taxes during a recession. Martha cannot believe it since there is no extra money to be had. Her choices are all bad. She can decide to not pay taxes and go to jail, or she can lay off another person. She decides against jail and lays off her office clerk and decides to do that job as well as her own company finance and payroll job and now works 7 days a week long days each day. Now it is just her and one parts guy and mechanic and two of her employees are out of work. Taxes drop off for the two employees and the government now takes in only $52,000, but must give out $100,000 for one salary and now $40,000 for two unemployment cases, for a total of $140,000. More money must be borrowed than is coming in. The government thinks about firing their worker, but decides against it for reasons we will not guess here.

Disturbed by these results after a few years, the government tries the FDR approach – give them government jobs solution.

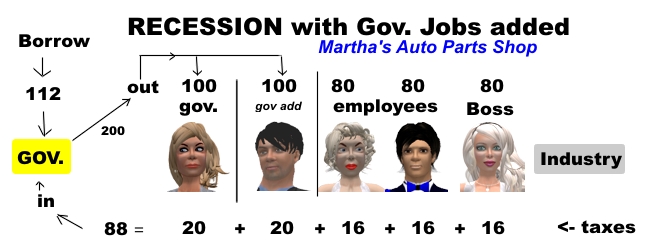

GIVE GOVERNMENT JOBS – during a recession

Okay, the government instead of doing the tax thing above, goes back to the last crossroads when Martha still had two employees and only Bart out of work. Whew. At least that much looks better. So the government gives Bart a job at the normal going rate of $100,000 a year. Well, now taxes are up a bit since Bart must now pay taxes. So the Government now has $88,000 coming in – much higher than last time, but wait, they now have two salaries to pay for and that is now $200,000 going out. So therefore they must borrow a horrible $112,000 just to make this small part of their country work. Aghast they try the third alternative, fixing the recession in private industry.

BACK TO THE RANCH

So, it is not clear what the government does to encourage industry to return to its starting point. Perhaps they lowered regulations, perhaps they lowered taxes, perhaps better trade agreements with other countries, perhaps they gave tax incentives, perhaps they lowered energy costs instead of raising them, perhaps they stopped threatening to force them into unions or public health. But whichever of those they did, they got it back to normal and once again the budget is balanced and there is no more borrowing and no more increasing debt.

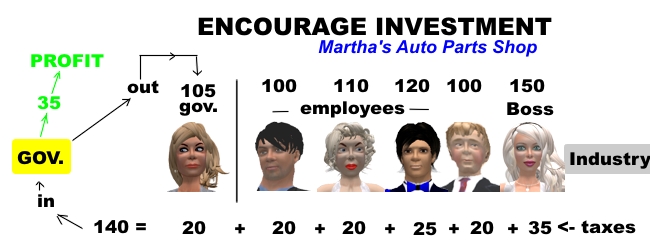

Then a few people think – hey why not go further than just stable, why not encourage industry. So they do that and get the next example:

ENCOURAGE INDUSTRY

Now Martha’s business is great! She cannot believe her good fortune and how lucky she is to be in a country that “gets it” and knows how to create wealth for the good of all. With much more business coming in, she hires another parts expert/mechanic Donald and of course has even before hired back her other employees. She gives two of them raises who stuck with her and one of those with the new raise is making enough more money now that he pays more in taxes. Martha herself is now for the first time making more money than her employees and also paying more taxes – which is just fine with her. Now the government is making more than ever before and has $140,000 coming in. GDP economy growth for the country is looking good and starting again to rival China. The government gives their employee at least a reasonable raise and then puts aside $35,000 for other programs or to expand government resources or other needs not yet determined. Everything is great. Everyone is smiling and happy. Well, maybe not everyone.

But the NY Times now sees that Martha is making more money than her employees and runs an article about evil CEOs and how they all must die ! die ! die! Michael Moore makes a movie called “the rape of our fair country by evil parts shop bosses” and liberals wait outside in the snow in long lines for hours to go see the movie and throw things at the screen. It is clear that Martha’s days are numbered – and so was this brief government prosperity.

Morals of the story

1. Do you hate the rich enough to kill yourself, your prosperity and the country for that cause?

2. Government cannot grow beyond a reasonable size (20% or so of the total perhaps) without ruining the country’s economy

3. When there is an issue we need to try and fix the problem where it is, and not try to fix it somewhere else – as in the government – where some think the light is better to see

4. For those who say this is a lie and that industry has windfall profits, well a few places might have, but that is not the rule. I know of the finances of about 20 companies now. Most are losing money. Losing money and going out of business is not windfall profits. The highest profit company I knew of – and I saw many books – was 5% profit per year. If inflation caused by government is 5%, then they break even. I cannot tell you how mad the term “windfall profits” by the unknowing upsets me. They are clueless. The reality is far closer to the examples above. If liberals do not believe this, I say, start your own business, as I have, and learn – while you take in those windfall profits.